Sleep No More

Picks & Pans Into Yearend

- The recent 3% selloff ends what had been the least volatile 4 week period since May 2014

- Probability of a September rate hike has gone from 18% to 48% and back to 18% in 4 weeks

- 84% of hedge funds tracked by Bloomberg have received redemption notices this year

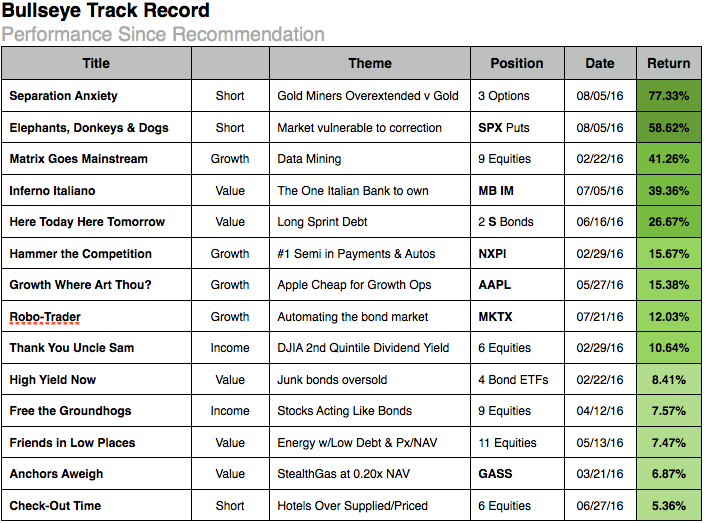

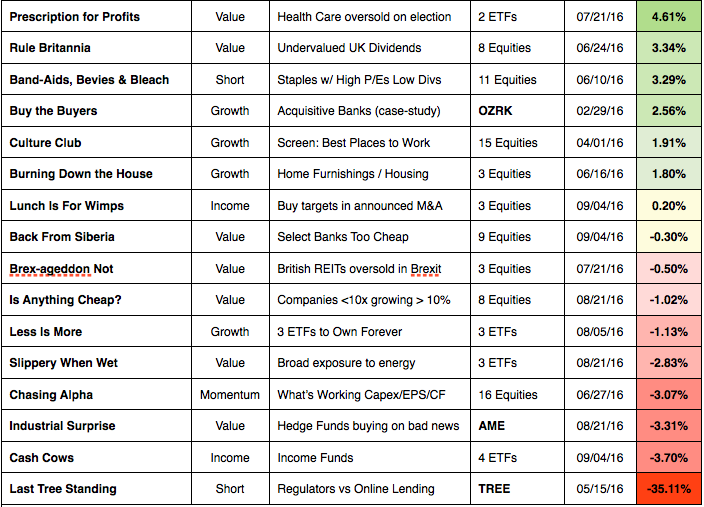

- Bullseye winners outnumber losers more than two to one (70% vs 30%)

August was perfect. I rode a Citibike to the office every morning and spent days admiring an exceptionally well-behaved portfolio. Longs worked higher and shorts edged lower. It was all exactly as it’s supposed to be. Then came Labor Day. In the span of 36 hours we learned investors are yanking money from hedge funds at the highest rate since 2009, U.S. economic indicators have taken a noticeable turn lower and no one has a clue about interest rates… especially The Fed! Sleep no more, volatility has returned with a vengeance and we have to weigh thoughtfully what we want to own into yearend.

Step One is to take inventory and identify what’s working, as well as what’s not. I have been publishing since the Spring, and my track record thus far is positive by a factor of 2:1. Puts on both gold miners and the S&P 500 Index have been my most profitable positions. Several specific stock and bond recommendations have also performed well. Most of the negative returns stem from ideas only recently discussed, which means they’ve taken it on the chin in September. Here’s a snapshot.

Before addressing the portfolio as a whole, let me first acknowledge the bright red nasty at the bottom of the list. LendingTree, Inc. (TREE) originates, processes and approves loans online. It operates on both a direct and agency basis, making loans for its own account as well as providing a platform for other banks to compete for customers (as Priceline and Orbitz do in the travel industry.) I believe regulators will ultimately take issue with how TREE presents borrowers to banks as “product.” In addition, its clearinghouse function may prove redundant long-term for large banks like J.P. Morgan which already have strong online solutions. That said, analysts hail it as a “new economy” stock and it’s a very hard short. No risk manager worth her salt would ever tolerate a 32% loss. Cover it.

All of my write-ups are available for your reference on the Past Issues tab, so you can easily access them for detailed analysis. What follows is an overview of important themes playing out right now, and how to position accordingly. I group positions thematically an offer essential charts and/or data for illustration.

Banks

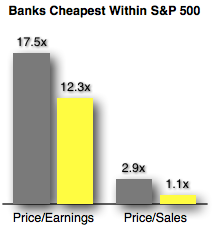

The appeal of banks as a long is three-fold: Valuation, Rising Rates (eventually) and they have been so reviled for so long. Morgan Stanley’s analyst team sums it up this way: While the group has been a “bellyflop” to own for the first half of year, Financials may pose the best opportunity in the second half of 2016. The bull case is predicated on low ownership, a fundamental expectation of improving revenue comps and still aggressive focus on expenses. Also, banks and asset managers which missed revenue estimates during the quarter actually had positive returns one week later, outperforming stocks in other sectors that missed revenue expectations. That itself is a hallmark sign of bottoming. Morgan Stanly overweight names include JP Morgan (JPM) and Bank of America (BAC). My own top picks are BofI Holding, Inc. (BOFI) and Bank of the Ozarks (OZRK). For more click https://bullseyebrief.com/home-siberia-issue-12-3-090416/

they have been so reviled for so long. Morgan Stanley’s analyst team sums it up this way: While the group has been a “bellyflop” to own for the first half of year, Financials may pose the best opportunity in the second half of 2016. The bull case is predicated on low ownership, a fundamental expectation of improving revenue comps and still aggressive focus on expenses. Also, banks and asset managers which missed revenue estimates during the quarter actually had positive returns one week later, outperforming stocks in other sectors that missed revenue expectations. That itself is a hallmark sign of bottoming. Morgan Stanly overweight names include JP Morgan (JPM) and Bank of America (BAC). My own top picks are BofI Holding, Inc. (BOFI) and Bank of the Ozarks (OZRK). For more click https://bullseyebrief.com/home-siberia-issue-12-3-090416/

Data Mining

IDC values the market for Big Data at $122B, which provides ample reason why the nine companies I profiled in February have since rallied over 41%. According to Bloomberg Senior Software Analyst Anurag Rana, “The ability of cloud application vendors to provide advanced analytics on their core products may become the single biggest distinguishing factor in the year ahead. Machine learning and other advanced data analysis methodologies are becoming increasingly important for clients to better understand their user-base. Rising use of Internet of Things (IoT) products will also fuel demand for analytics. Pure-play visualization vendors will likely expand their product portfolio as competition increases.” Data is everything right now, from Target’s Cartwheel app which tracks you in the store to Honeywell’s decision to hire hundreds of software engineers. Own this theme. https://bullseyebrief.com/matrix-goes-mainstream-issue-1/

Energy

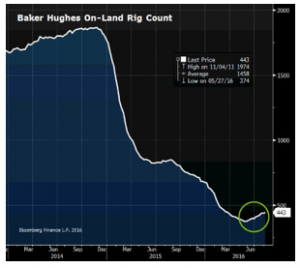

I admit I LOVE taking about oil, both because I began my career trading jet fuel a t Louis Dreyfus Energy and because oil so integral to the global economy. The essential thesis behind owning energy NOW is that so much production has been taken offline we are not finding replacement barrels to satisfy future demand –the Baker Hughes Index of active

t Louis Dreyfus Energy and because oil so integral to the global economy. The essential thesis behind owning energy NOW is that so much production has been taken offline we are not finding replacement barrels to satisfy future demand –the Baker Hughes Index of active

drilling rigs has fallen 75% since 2014. While the International Energy Agency calls for the current supply overhang to persist into 2017, lack of activity is setting the stage for the next rally. I want to buy best-in-breed assets in anticipation. As I have noted on multiple occasions, EOG Resources, Inc. (EOG) and Concho Resources, Inc. (CXO) are the only two exploration and production companies which consistently fund new drilling projects with cash flow from existing wells. They are the two to own.

Health Care

The election has turned health care into a political punching bag as candidates vie for votes. Each side has promised to defend “average Americans” from rising costs and inefficiencies. However I suspect the bark will likely prove worse than the bite. More importantly, the demand side of health care is staggering. U.S. health spending in 2016 will exceed $10k per person for the first time, and total health care expenditures at 17.8% of GDP will rise to 20% by 2025. The surge is driven largely by three million baby boomers who will reach retirement every year for the next 25 years and require 1.6M new care providers by 2020 according to the National Council on Aging (NCOA). This is obviously a macro call so the easiest way to get exposure is through exchange traded funds, specifically the SPDR S&P Biotech ETF (XBI) and the SPDR S&P Pharmaceutical ETF (XBH).

Gold Miners

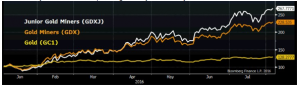

Sometimes a picture is worth a thousand words. I showed this chart in July to illustrate how miners have become totally detached from the price of gold. They still are. Stay Short. Btw, my favorite poster child for overextended miners has fallen 22% from its high –Coeur Mining, Inc. (CDE). If you didn’t short it then, there’s still time. It’s up 401% YTD.

REITs

On my recent podcast I described REITs as Real Estate Investment Traps. Here’s the negative thesis in a nutshell. First, higher rates imply higher borrowing costs for REITs, which squeezes margins and lowers cash flow available to fund dividends. Second, many current project were financed at historically low cap rates of 3-4%, meaning developers will have to own properties at 100% occupancy for 25-30 years to recoup their initial investments. This is not a prudent business model. Third, e-commerce now accounts for 8.7% of total retail sales, which means mall REITs in particular are losing their core customers. Macy’s, Sears and even Target have announced store closings recently. This does not bode well. Sadly, individual investors have plowed more money into the sector this year than any other. Do not own this group. Short it via General Growth Properties (GGP), hotel operators which pay rents to REITs Hyatt Hotels (H), Marriott International (MAR), Wyndham Worldwide Corp (WYN) and the Vanguard REIT ETF (VNQ).

Staples

Boring staples became one of the darling sectors of the market a couple of years ago once investors realized the Fed was going to keep rates lower for far longer than anyone expected. In a low growth, low rate environment, their stable cash flows and dividends started to look pretty good, even if band-aids and bleach weren’t exactly growth categories. The group attracted so much capital that the shear inflow pushed valuations to 25-30 times earnings, which also meant that the whole reason to own them (ie 3% dividend yields) got squeezed down to below 2%. Sorry, but that math doesn’t work. I identified a handful of names that have no business trading at current valuations. Church & Dwight (CHD) is particularly egregious at 27.4 times this year’s earnings, with a dividend of just 1.5%. Baking soda doesn’t deserve that much affection. https://bullseyebrief.com/band-aids-beverages-bleach-issue-6-1/ ![]()

Subscribe at https://bullseyebrief.com