Industrial Surprise

Guiding Down but Getting Bought

- AMTEK Inc. (AME) issues two disappointing earnings reports and notable buyers acquire shares

- Volume spikes on down days establish $45 as triple bottom underpinning stock price

- Management trims guidance for second time and offers detailed outlook by segment

- $1B cash available for opportunistic and accretive acquisitions my provide upward catalyst

I’ve been trying to get excited about beleaguered industrials on the assumption every dog has its day. Now I finally have reason to pay attention. 13-F filings released this week reveal activist investor Dan Loeb of Third Point Partners has initiated a position in oft-overlooked AMETEK, Inc. (AME). To quote one of my favorite special situations strategists, Don Bilson of Gordon Haskett “It’s hard to find a name more under the hedge fund radar than AMETEK… coming out of Q1, not a single hedge fund manager was a top-30 holder.” Nonetheless, Mr. Loeb now has a stake and he’s been buying on terrible news. So have the top three shareholders (Fidelity, BlackRock and Vanguard). When avowed activists hedge funds and and deep-pocked mutual funds join forces, I pay attention.

Take a look at the one-year chart of this $11B roll-up of electronics manufacturing businesses. Three times since April the company has sold off on terrible news, including two earnings disappointments and lowered guidance. Yet each case proved a buying opportunity, which is what makes this picture interesting. Again, when strong-handed pros buy on bad news, we should try to understand why.

Buying Bad News

AMETEK, Inc (AME)

Note the volume spikes each time the stock sold-off. Clearly a lot of disappointed investors were voting with their feet, though buying ultimately trumped selling and the stock rebounded. I’m especially intrigued by the near instantaneous bounce two weeks ago when new CEO David Zapico lowered guidance. With 11 of 17 analysts rating the stock a buy, and not a single seller among them, there’s something happening here. This action is unusual, especially for an industrial stock unaccustomed to headlines.

To get a better sense for what’s happening, I’ve extracted key moments from the earnings call on August 4th, when the stock opened down 7.5% but managed to close nearly flat. You can hear how the tone of the conversation changes, beginning with the guidance cut. CEO David Zapico’s words appear in italics.

Visibility has remained limited as customers are cautious and are aggressively managing their inventory levels and capital spending plans. We do not anticipate a modest second half improvement, as we had expected. As a result, we now forecast revenue to be down low single digits.

Stifel Nicolaus: Is it unlikely will we get another cut?

There is not going to be another cut. We feel the business has stabilized, especially energy. Our customers are telling us, based on some of the commentary you’ve heard from Halliburton, Baker Hughes and Schlumberger that rig counts have bottomed.

The two markets that are down, about 20% of our company –oil and gas and metals– are down 30%. That’s a difficult headwind to offset but we still have 22.4% operating margins and we’ve had a good operating quarter. Free cash flow was strong at $175 million in the second quarter, up 15% over last year.

BMO Capital Markets: But the truck is falling apart…

Many of you have followed Ametek for quite a while, and in the past our forecasting process has yielded very consistent results, but it hasn’t the last few quarters. It’s a difficult environment. Customers are delaying capital projects and managing inventory aggressively. Emerging markets are challenged.

So we’re taking a different approach to forecasting. We got our entire executive office involved. We took a deep analytical review of each niche business to understand their specific forecasts and to better assess potential risk. We spoke to the financial community. It’s a more time consuming process but we felt it’s the right thing to do at this point. It’s a rigorous process and I feel confident in the results.

BMO Capital Markets: Is there a lift to the cost savings number?

Our cost reductions are $130 million for the year. We are purchasing less material… we are balanced in revenues and expenses so we have a natural hedge. Uncertainty is going to go on for some time, but we’re feeling pretty good about our exposure.

No area is immune from efficiency improvement. We are going to look at things like global sourcing, low-cost region production, value analysis, value engineering, plant consolidation… with all of the tools that we have we are going to get a healthy cost reduction target. And we are going to pair that with acquisitions and that’s how we are going to grow our earnings next year.

Robert Baird: Should we think about downshifting core growth to more of a GDP number?

Through the cycle of the last 10 years we grew earnings 16% compounded annually. We need to adapt our strategy to the new reality in the marketplace, in order to ensure we’re going to be able to double earnings over the next five years… with a combination of mid-single digit organic growth and adding acquisitions of 5-10% a year.

Stifel Nicolaus: How do you think about M&A and public deals in this environment?

We have a solid pipeline. Our sweet spot is that $50 to $200 million dollar deal, but we’ve expanded our horizons are looking up to $500 million in revenue. We do deals that add the most value and we are very selective. We have four deals done this year and we deployed $360 million in capital. We have $1 billion of capacity within our existing credit lines and cash on hand. More importantly our operating cash flow is $750 million and I think this can be a significant driver for 2016 and 2017 performance.

Jefferies: Can you give us some color on emerging markets?

Sure, I’ll go around the world. In the U.S. we were down high single digits versus last year… oil, gas and metals… in Europe low single digits. Asia is stabilizing, China is stabilizing and one emerging market I’d point out that is doing better is India with mid-single digit growth. With the strong dollar we are relocating to low cost locations, and in most situations we don’t have competitors so that give us an advantage. We are naturally hedged in most of our markets.

RBC: Do you have orders or backlog to give you confidence about stabilization?

Yes. Our backlog is $1.1 billion. If we look at the run rates, and we’ve spent a lot of detail on it, it gives us confidence in the back half of the year.

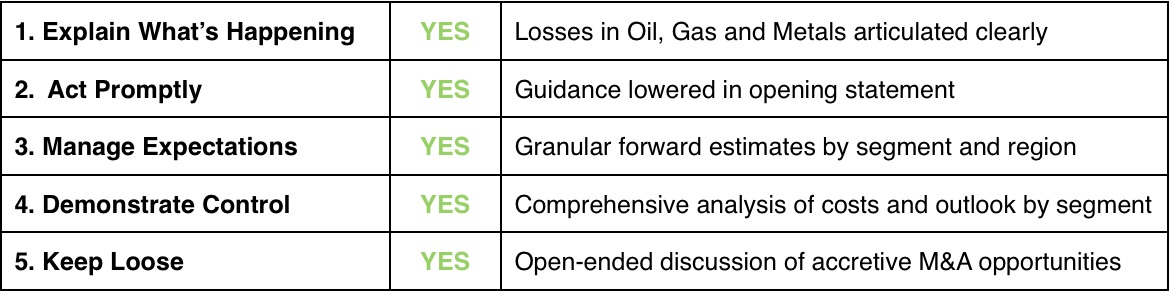

Some of the questions got a little testy, as you might expect when a company guides down twice in three months and effectively bags the analysts in the process. However, Mr. Zapico has worked at the company for several decades and his intimate knowledge of the businesses paid off. In addition, he handled himself like a pro. Harvard Business Review contributor John Baldoni has written extensively on how effective leaders react to crises. His checklist includes five basic categories, and Mr. Zapico scores five for five.

Crisis Management Checklist

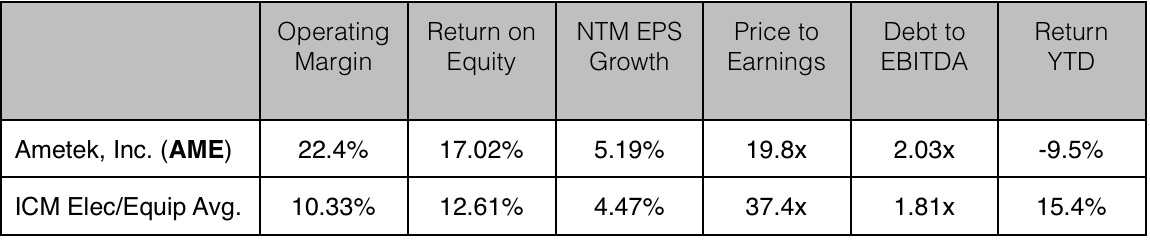

Admittedly, this is all a little touchy-feely so we need some NUMBERS. What distinguishes Ametek from other electrical/industrial manufacturers is its 2x wider Operating Margins and superior Return on Equity. As for valuation, its P/E is comparable to the market but well below the group. It’s also down on the year, which provides additional room to play “catch up.” Bottom Line: What we’re buying in AME is a management team and its ability to identify, acquire and integrate complementary businesses. I think of Ametek as a medium-term call option on improving economic growth and rotation into overlooked industrials. This theme may take time to play out, but I like betting alongside Loeb and Fidelity.

Vital Stats

Subscribe at https://bullseyebrief.com