Free the Groundhogs

9 Stocks Behaving Like Bonds

- S&P 500 valuation exceeds 50-yr average in spite of significantly lower earnings growth

- Only 15% of companies in the Russell 3000 are rated Investment Grade by Moody’s

- Traditional income funds currently offer poor risk/reward vs. long-term metrics

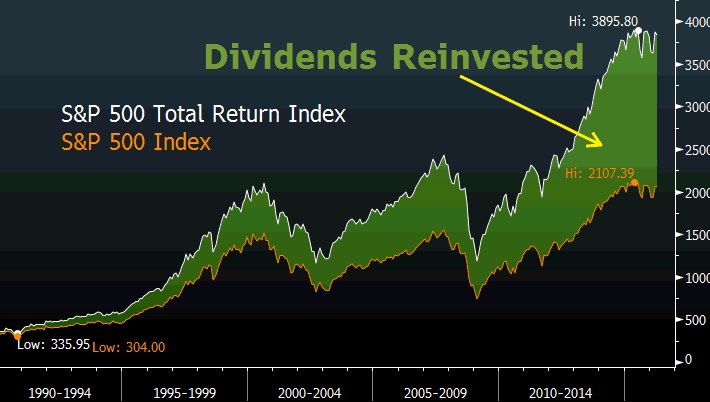

- Dividends have accounted for nearly half of stock market return since 1990

Bonds have become the new stocks. In our upside down world of negative interest rates, where the IMF lowers its global growth forecasts every six months and U.S. corporate earnings will likely decline for a fourth consecutive quarter, sovereign bonds keep rising. Stocks meanwhile go nowhere. The U.S. 10-year note has now risen 30 points above par, while the S&P 500 has hugged 2,000 for two years. To escape this Groundhog Day of mind-numbing repetition we need to adjust our playbook. If Bill Murray can break the spell AND get the girl, so can we. Time to start looking for stocks that act more like bonds.

I may sound facetious, but I’m actually quite serious. The team at Strategas Research first alerted us to this notion of stocks acting like bonds, and we agree with their thesis of focusing on steady income at this point in the cycle. It’s not just that bonds are rising and stocks are stalling. It’s also that dividend streams from stocks start to look a like coupon payments from bonds when stock prices stop rising. In other words, potential capital gains may be few, but prospects for current income are still attractive.

Okay, I recognize bond analysts tend to get a bad wrap, lawyerly types who wring their hands over the contingent liabilities and seniority in default. In fairness, they’re just counting cash flow like the rest of us, and stock jocks would be well served to focus more on money and less on moonshot. Ten-baggers are tempting but hard to find. While Bloomberg’s IPO Index has fallen 19% over the past year, dividends continue to add up. Since 1990, dividends have accounted for 47% of total stock market return. The wealth may take longer to accumulate, but it accrues consistently.

For the Love of Money

Cumulative Returns Since 1990

Admitedly there is a catch. Some of the best known dividend funds have failed to keep up. Take the venerable $96B Income Fund of America (AMECX) for example, which practically wrote the book on dedicated income funds when it launched in 1973. The fund has lost 6.15% for the 12 months ended 4/10/16, significantly more than the 1.45% decline for the S&P 500 Index… in spite of paying a 3.2% dividend yield. What’s worse, the fund charges 5.75% when you buy, 1.00% as you sell and 0.22% each year of ownership. If you bought last April and just decided to bail, you are down 13.12%.

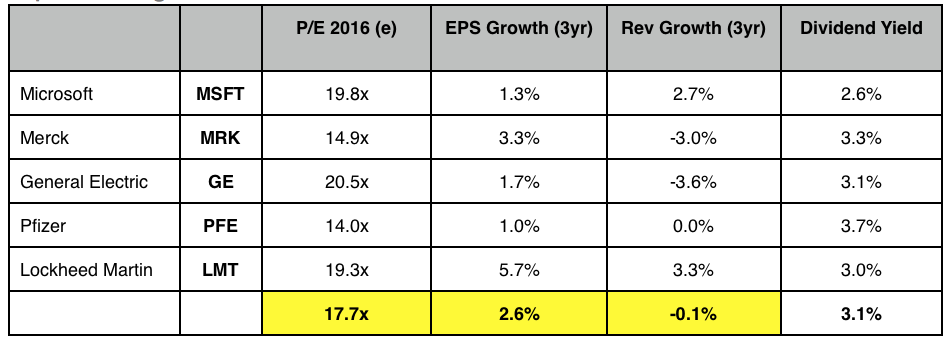

Income Fund of America currently holds over 1,600 separate positions, and the top five holdings (12.4% of assets) illustrate why it struggles to make headway. Simply put, valuation is high and growth is low.

Bad Combo

Top 5 Holdings at AMECX

I appreciate the 3.2% average dividend yield of these five companies, but “coupon” is only part of the story. When we say we want stocks which act like bonds, they need to pay dividends AND offer enough upside that capital gains are a reasonable aspiration. Bonds have been able to eek out gains because the underlying fundamentals –minimal inflation and accommodative monetary policy– continue to provide consistent tailwinds. By contrast the stocks noted here offer very little runway. We simply cannot argue in favor of high teen multiples when growth is virtually non-existent.

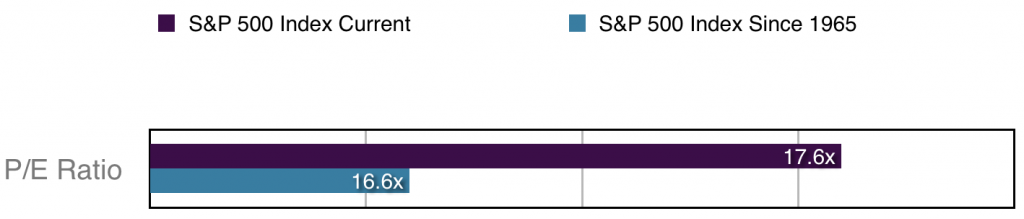

Lest you think we’re picking on AMECX, the same state of affairs applies to the broader market as well.

Stocks Cost More…

But Growth is Anemic…

And Dividends are Lower…Ugh!

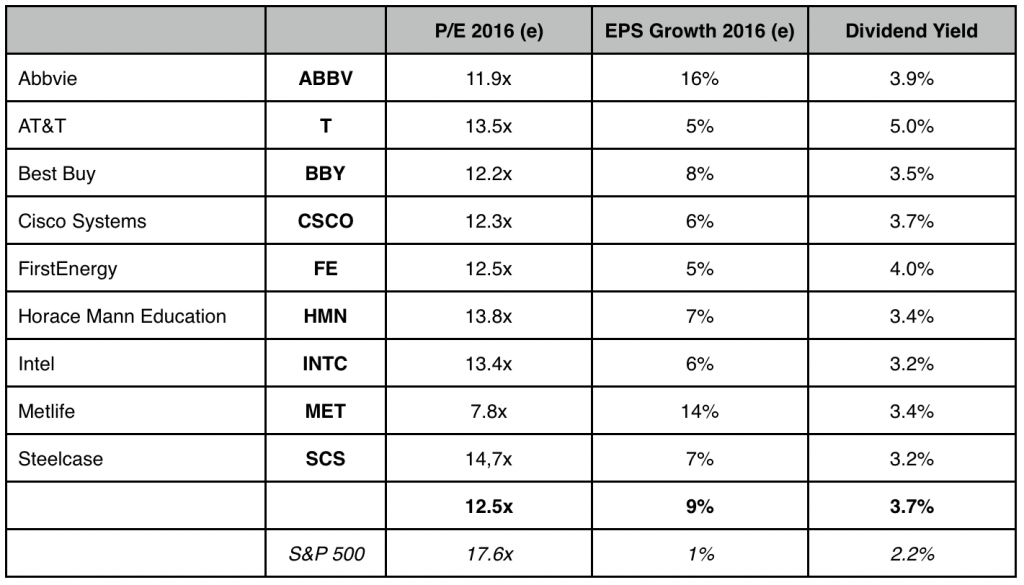

The point here is we need a new strategy. We cannot continue to blindly step out of our holes in search of shadows and expect winter to go away. Ms. Yellen and her European counterparts will continue repressing rates, holding assets aloft and income streams down. So we are creating our own income fund, screening Russell 3000 Index components for that elusive combination of yield, growth and value:

- Senior Unsecured Debt rated Baa or higher

- Forward 12-month P/E ratio less than 15x

- Forward 12-month earnings growth estimates greater than 5%

- Forward 3-year projected dividend growth greater than 0% (Bloomberg model)

- Minimum dividend yield of 3.0%

Better, Stronger, Faster

Stock Screen Results

Only 9 stocks made our screen –from an initial field of 3,000– because I purposely made the criteria highly restrictive. As the current bull market enters its 85th month, well past the average of 59 months following recessions since WWII, we think high quality companies matter now more than ever. In fact, narrowing our field to just investment grade companies eliminated 85% of the index before we even considered earnings, yield and valuation… an amazing statistic in and of itself!

The figures above show this group of nine companies offers significantly better risk/reward than the broader market. We also note an average beta of 0.96, meaning they are less volatile than the market. In addition, the group has returned nearly 4% as of mid April, double the return of the S&P 500 Index.

Consistency may be hard to find, but it’s out there… just ask a groundhog.