Burning Down the House

Housing’s 3 Dos & 1 Don’t

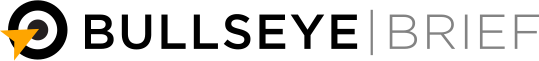

- Existing home sales still 23% below trend despite record U.S. personal income

- By contrast, spending on renovations and repairs is up 27%

- Bloomberg Homebuilders Index trades at 1.3x book value vs 0.77 in 2007

- Home Furnishings group offers better value and superior earnings growth

Everyone’s an expert on housing until it’s time to sell, and then you pray for a bid. This week I have read multiple research reports from some of the highest-rated analysts on Wall Street who extoll the outlook for housing. To quote the team at Wells Fargo, “All year we have been making the case that 2016 would be a break-out year for homebuilding, and finally the data are beginning to support our argument.” Only problem, strong data in April does not a trend make, and Easter in March won’t happen again til 2035, so April may have been just another head fake.

In fairness, the bullish case for housing hinges on far more than one month’s figures. Powerful underlying demographics suggest the U.S. housing market is a coiled spring ready to unleash significant momentum:

• U.S. Unemployment has fallen to 4.7%, the lowest since late 2007

• U.S. Disposable Income has surpassed the pre-crisis high by 21% to $13.9T

• 12% of employers plan to raise wages in the next 12 months according the the NFIB

• New household formations of 538k this year remain 41% below the 25-year average

• U.S. Personal Savings rate has risen to 5.4% of income, more than double the pre-crisis rate

• Gasoline costs remain 33% below 2013-14 levels

• 30-yr fixed rate mortgages remain near record lows at 3.73%

So we have seven compelling reasons why home sales should be through the roof, yet they’re still just a fraction of the pre-crisis high… and 23% below trend according to Bloomberg Intelligence. I cannot even imagine the closed door conversations at Janet Yellen’s Fed, or the table pounding in conference rooms at the homebuilders’ offices. If ever the stars had aligned in favor of housing, surely this is it.

Housing’s Disconnect

Buyers Have Money But Aren’t Buying

For all the logical reasons why buyers should be buying, they are not. Maybe they don’t like the fact that home prices have rebounded nationally to within 10% of all-time highs per Case-Shiller data. In “hot” markets like New York, Portland and San Francisco, tight rental conditions and high end condo prices have gone well past old highs, though my friend Jonathan Miller of Miller-Samuels Inc. assures me the trends won’t last. He says asking prices for the top-end have come down 5-10%, and by top-end he means +$5M. Let’s just say that’s a little north of where I shop, but his insight is corroborated by the recent announcement from Equity Residential (EQR) that new leases are falling short of estimates. This revelation in the first week of June had a somewhat chilling effect on fellow REITs Avalon Bay Communities (AVB), Essex Property Trust (ESS) and UDR Inc. (UDR).

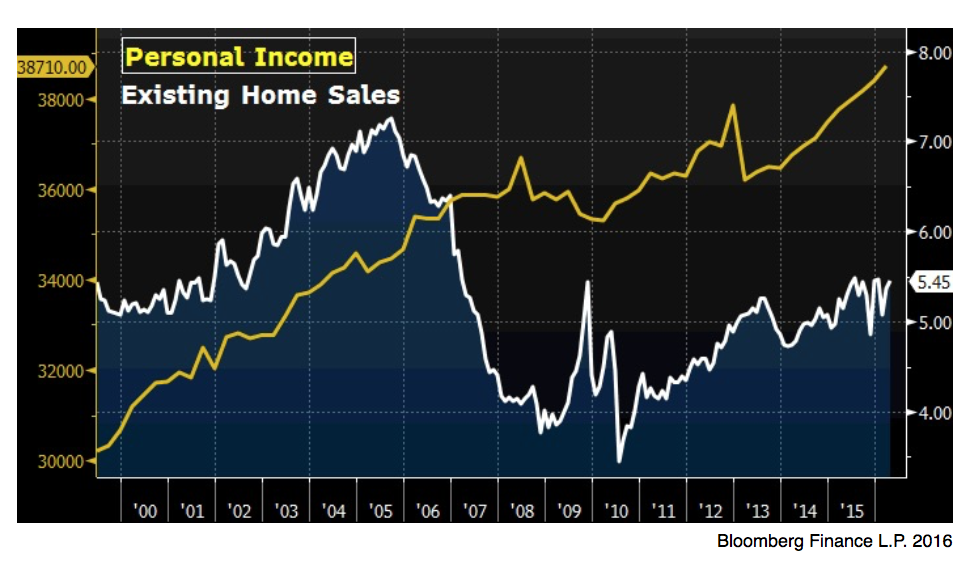

If I sound negative, please forgive me. I am desperately trying to embrace the data and likewise the stocks. However I am troubled by the disconnect in the first chart, and even more so by investors’ unbridled enthusiasm for the group. As an example, homebuilder NVR, Inc. earned $103.93/share in 2007 and will likely earn $109.52 this year based on consensus estimates tracked by Bloomberg, an increase of about 5%. Meanwhile the stock has risen 183% over the same period. Think about that… 5% earnings growth, 183% stock appreciation. This is not rational.

NVR may be the poster child for unconditional love, but there’s plenty of hand-holding to go around. Consider Toll Brothers (TOL) and Lennar Inc. (LEN). Earnings have fallen 40-50% compared to pre-crisis highs, but the stocks are only down 20-30%. Investors don’t want to miss the bounce. Also important, while current P/E ratios don’t appear high compared to the S&P 500 Index, they are high historically. Homebuilders tend to trade cheap… like supermarkets, autos and airlines. In addition, the 19 homebuilders in Bloomberg’s proprietary index currently trade at an average of 1.3x book value, a significant PREMIUM to the 2007 average of 0.77x. If you think homebuilders are currently cheap, please think again.

Devil’s in the Details

Perspective on Homebuilders

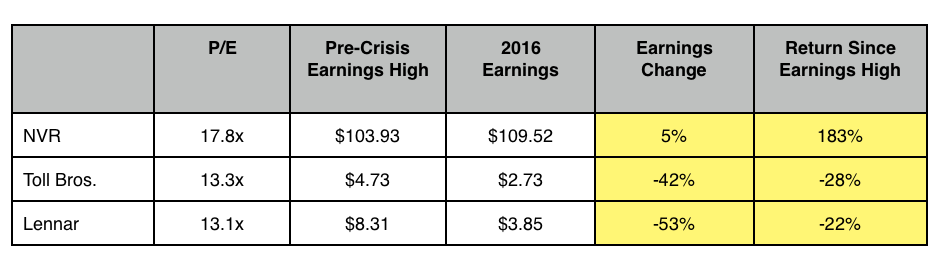

Fortunately, not all the data are bad. In fact, the renovation and home improvement market appears quite healthy. Home spending rose more than 27% in 2015 according to the U.S. Census Bureau, the highest since 2005 and well above historical norms.

Record earnings coupled with mid-teens growth at both Home Depot (HD) and Lowe’s Home Improvement Centers (LOW) confirm the trend. People may not be buying homes, but they are certainly taking care of the ones where they live. The point here is this: We can play the strong demographic case for housing without buying the homebuilders. We can simply buy all the stuff that goes into making homes look their best: Cabinetry, Flooring, Fixtures and Paint.

So in our binary world of Housing’s Dos & Dont’s: Don’t buy the homebuilders… Do buy the home furnishers. Here are three in particular:

1. Mohawk Industries Inc. (MHK) is the largest global flooring manufacturer, controlling 21% of the market according to Floor Focus Magazine. Demand for its core products (Laminate/Wood/Ceramic/Carpet) is growing mid-single digits, while earnings are growing an average of 20-25% on a combination of leveraging fixed costs thru merger synergies and $600M in capex to improve high margin businesses. The company has beaten earnings estimates in 17 of the last 18 quarters and raised guidance after the Q1 report. Mohawk reports Q2 earnings on June 16. It currently trades at 16.2 times earnings, cheaper than the S&P 500 with 3 times the growth.

2. Masco Corp. (MAS) derives 83% of sales from Repair & Remodeling as a leading manufacturer of building products in four primary segments: Plumbing (47%); Decorative Architectural Elements (28%); Cabinets (14%); Specialty/Custom (11%). Management recently guided to 7% annualized sales growth and 16% operating profitability on its recent restructuring, which consolidated production into fewer facilities and cut debt by $400M. 17 of 24 analysts tracked by Bloomberg rate MAS as a buy (no sells) and on average they forecast 8% free cash flow growth. The company intends to deploy $2B through 2017 on repurchases, dividends, debt reduction and bolt-on acquisitions. With earnings growth forecasts of 28% this year and 20% in 2017, MAS trades at 20.8x 2016 earnings, a slight premium to the S&P 500 Index.

3. Sherwin-Williams (SHW). I admit this one gives me slight pause, trading 23.1 times 2016 earnings and very close to all-time highs. Yet the fundamental story is very solid. Its $11.3B pending merger with Valspar will generate combined pro-forma sales of $15.6B, making it the global leader in paint manufacturing and distribution. Strong M&A synergies suggest incremental EBITDA margins between 30-40%, which is in part why the deal is immediately accretive. SHW’s 4,300 retail paint stores generated same store sales growth 9.4% in Q1, and the partnership with with Lowe’s produced 7.4% gains. Since house paint accounts for 77% of SHW sales, the Repair and Restoration thesis is clearly playing out in the results. There are three risks to this story: Merger Integration; Continued low raw material costs linked to commodity prices; overall valuation. Sherwin-Williams is a stock to own at the right price. So put it on the radar and buy on down days. Generous options premiums also make it an excellent candidate for covered call writing (Long stock and short call). For example, buy the stock at $290 and sell the July 290 call at $8 for a 3% cushion, that’s a 26% annualized return.